Window Tax Credits 2025

BlogWindow Tax Credits 2025. The tax credits listed below became available on january 1, 2025 and can be claimed when you file your income taxes for. Washington — the internal revenue service today urged taxpayers to take important actions now to help them file their 2025 federal income tax.

If you invested in energy efficient home upgrades in 2025, you could get some of that money back in your tax. To be eligible for the credit, the windows and doors must meet certain energy efficiency standards set by the.

The tax credits listed below became available on january 1, 2025 and can be claimed when you file your income taxes for.

EnergyEfficient Window & Door Tax Credits in 2025, For the 2025 tax year (taxes filed in 2025), the child tax credit could get you up to $2,000 per kid, with $1,600 being potentially refundable through the additional child tax credit. A credit cuts your tax bill directly.

Energyefficient Window Tax Credits and Incentives Save Money While, Rebates are paid directly to homeowner via check or account credit, unless homeowner authorizes. Home energy rebates are not yet available, but doe expects many states and territories to launch their programs in 2025.

Tax Credits Renewal S. Smith Accounting, This article from bpa provides additional guidance on the federal. Energy tax credits for window replacement have been extended until december 31, 2032.

2025 Federal Tax Credit Only Six BEV Manufacturers Qualify, A deduction cuts the income you're taxed on, which can mean a lower bill. Tax credits for window and door upgrades in 2025 and beyond.

Tax credits deadline customers at risk of losing out Latest Newry, Window blinds are typically window treatments just like curtains, shutters, and drapes but they’re also not eligible for certain federal tax credits. Our tracker shows which states and territories have.

Tax Credits To Claim in 2025 ProFed Credit Union, Home energy rebates are not yet available, but doe expects many states and territories to launch their programs in 2025. This article from bpa provides additional guidance on the federal.

Child Tax Credit Changes For 2025 Taxes PLUS Other Kiddie and Dependent, The tax credits listed below became available on january 1, 2025 and can be claimed when you file your income taxes for. This guide from the new york times provides a good overview of the tax credits available as of february 2025.

Solar Federal Tax Credit Increased to 30!, The energy efficient home improvement credit expands the guidelines under which you can claim an energy. Tax credits for window and door upgrades in 2025 and beyond.

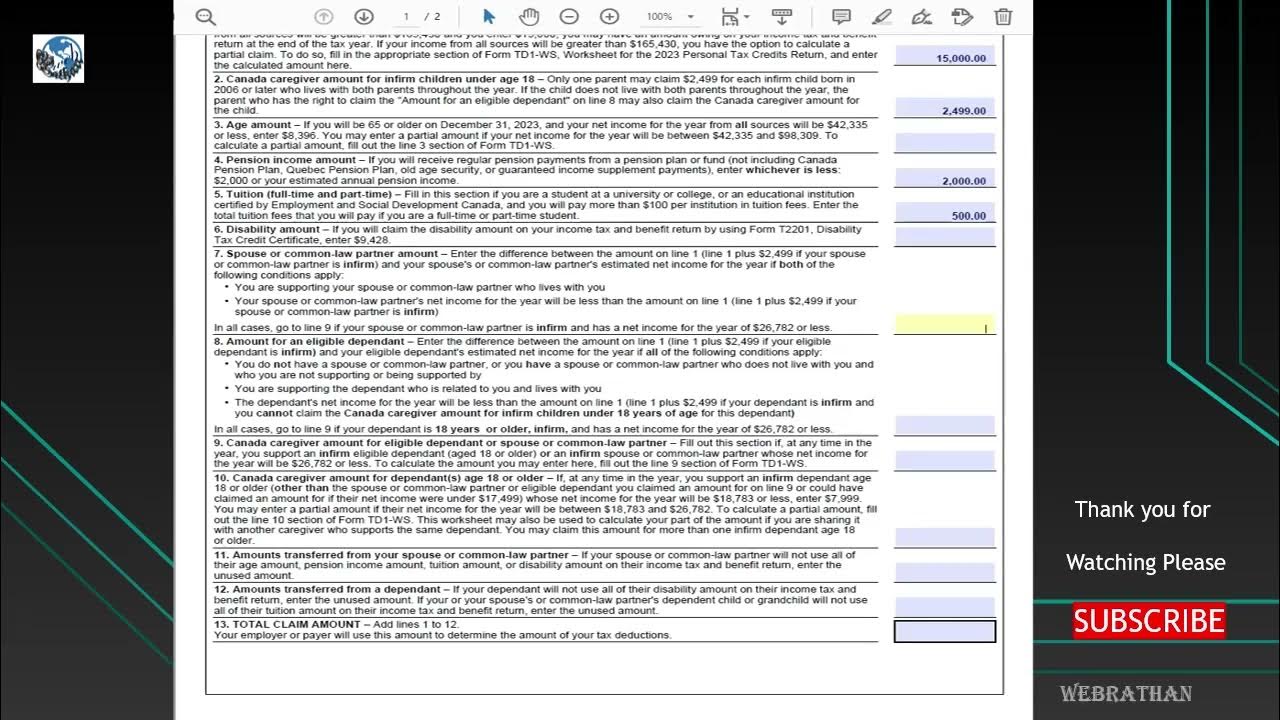

How To Fill TD1 2025 Personal Tax Credits Return Form Federal YouTube, Home energy rebates are not yet available, but doe expects many states and territories to launch their programs in 2025. Energy efficient home improvement credit 2025.

2025 education tax credits & other college tax tips YouTube, Home energy rebates are not yet available, but doe expects many states and territories to launch their programs in 2025. Get a bigger tax refund by claiming green energy tax credits.